Life Sciences

Drug Discovery Services Market 23rd May 2023

1.1 MARKET SYNOPSIS

Drug discovery services refer to outsourcing of services that include hit identification, target validation, lead optimization, pre-clinical candidate validation for a variety of therapeutic areas. Research focused pharmacetuceutical and biotech firms these activities to contract research organizations (CROs) which . The leading CROs (drug discovery service providers) in this market are – Laboratory Corporation of America Holdings (US), Charles River Laboratories International Inc. (US), Thermo fisher Scientific (US) and Wuxi AppTech (China). These major players account for over 40% share in the global drug discovery services market.

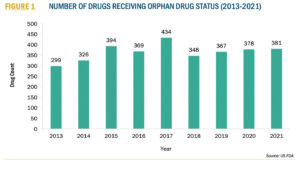

R&D initiatives targeted towards discovery & development for rare disorders is set to drive the market growth for next 3-5 years. Increasing focus of pharmaceutical companies on developing drugs for rare diseases facilitates the adoption of drug discovery services. This is further supported by advent of techniques that aid in identification of the genetic causes of rare diseases. In the past two decades, there has been a surge in the number of orphan indications approved in the US. Since 2010, the share of orphan drugs spending has increased by 5% due to the growing number of approved orphan products.

High cost of in-house drug development are driving the pharmaceutical & biotech companies to outsource drug discovery services from CROs. According to a recent study by the Tufts Center for the Study of Drug Development, it takes USD 2.6 billion for drugmakers to get approval to launch a new drug in the market, and the rate of success is just 12%. According to a Forbes article published in October 2022, drug discovery, on an average, takes 8 to 15 years, with a cost of up to USD 2.5 billion. Despite this, 90% of the drugs in development fail in the regulatory phases.

Increasing investment in pharmaceutical R&D and initiatives for research on rare diseases and orphan drugs are creating significant demand for drug discovery services. In addition, the high cost of in-house drug development encourages pharma biotech companies to outsource contract R&D services, which is expected to drive the drug discovery services market.

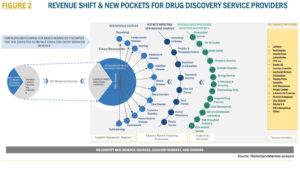

Increasing penetration of AI-based tools for drug discovery and the shift toward integrated end-to-end services for drug R&D are expected to change the business revenue mix for drug discovery service providers in the next three to five years.

Hit-to-lead identification represents largest share in the drug discovery services market and this segment is also set to grow at the fastest pace. Analyzing the results of HTS is a crucial step in the lead discovery process and requires complex laboratory automation. A typical program-critical path within the lead discovery phase consists of many activities and begins with developing biological assays, which are used to screen compound libraries to identify the molecules of interest. Many current hit-to-lead processes have been further improved by increasing the use of calculations used to measure a drug’s ligand efficiency (LE), lipophilic efficiency (LipE), and lipophilic ligand efficiency (LLE).

North America is at the forefront of drug discovery services with the highest revenue contribution of US. This can be attributed to the presence of well-established CROs, rising R&D expenditure by pharmaceutical & biopharmaceutical companies, rapid growth in the biosimilar and biologics markets, and the availability of the latest techniques, instruments, and facilities for drug discovery research. Presence of pharmaceutical giants such as Pfizer, Inc. (US), AbbVie, Inc. (US), and Johnson & Johnson (US) in this region supports the drug discovery services market growth in this region.

1.2 MARKET TRENDS – AI IN DRUG DISCOVERY PROCESS

Artificial intelligence and machine learning make the drug discovery process more efficient and substantially improve success rates at the early stages of drug development. AI algorithms ingest and analyze a vast amount of information and identify potential drug candidates in shorter periods. Deep learning systems can also generate molecules with properties that are likely to be effective against specific diseases without adverse side effects. Such advantages have encouraged the adoption of AI for drug discovery by various pharmaceutical and biotechnology companies. For instance, in February 2023, a Hong Kong- and Shanghai-based artificial intelligence drug discovery company Insilico Medicine recently discovered a new drug using its technology, INS018-055 for idiothetic pulmonary fibrosis (IPF).

This encourages CROs to bring about breakthroughs, as AI plays an important role in discovering drugs for chronic diseases such as cancer. Owing to its capabilities, AI significantly reduces the time taken to bring a cancer-combatting drug to the market; this will lead to significant growth in the drug discovery services market. Several contract research organizations are increasingly focusing on developing AI solutions and partnering with established and emerging AI-driven companies to leverage the power of AI-based solutions to boost their drug discovery programs.

Partnership with CROs for drug discovery serves as a major opportunity to minimize the associated costs and makes capital investment efficient in the discovery and development process. Specialization in a few specific components of the drug discovery and development process works as an advantage for entities executing individual research projects to minimize costs. Many CROs are developing such specialized portfolio to sustain the market competition. Other driving factors such as, increase in R&D expenditure in pharma-biotech sector, expanding pipeline of novel drug candidates, and initiatives for research on rare diseases have rendered the drug discovery services market a healthy CAGR of 14.9% from 2023-2028.